I used to a play a pencil and paper game called Shadow Run, where you and your friends pretend to be a band of adventure seeking bounty hunters working for major corporations in a post-apocalyptic world similar to the movie Johnny Mnemonic. In this crazy, post-apocalyptic world, it was quite easy to buy medical evacuation and rescue insurance from a company called DocWagon. The only restriction which I recall is that the rescuers wouldn’t intervene in a gun fight, though they would brave some danger. In real life it’s much more complex if you’re into adventure travel.

I’m researching medical evacuation, and search and rescue insurance for a trip I’m taking to ride motorcycles in Nepal and Tibet with a group. I’ve probably spent 10+ hours reading, calling, and chatting with people to get educated enough to feel competent in buying what I need. I’m writing this article to try and save you some of this work, and also to remind me in a couple of years when I forget all of the details!

I think the best way to understand all of this is with some example scenarios which convey a lot of information very quickly!

Example Scenarios

Here’s a fictional example with no medical evacuation insurance, no search and rescue insurance, and no satellite communication device:

- While exploring the remote backcountry trails of New Zealand’s Fiordland National Park, Emma, an avid backpacker, slips on a wet rock and injures her ankle severely. With no nearby cell reception and no satellite communication device, Emma is unable to call for help. Alone and unable to walk, she waits for hours in pain, hoping for assistance from passing hikers. Eventually, a group of fellow backpackers stumbles upon her, but without rescue insurance or medical evacuation coverage, Emma faces the daunting prospect of navigating rugged terrain to reach medical help on her own, highlighting the critical importance of emergency preparedness and travel insurance in remote wilderness areas.

Here’s a fictional example of using a Garmin InReach without medical evacuation or search and rescue insurance:

Here’s a real-world example from a friend who’s tour guide managed things:

- Ross was on a guided motorcycle tour in Botswana which is flat but remote. A cow scrambled out of a culvert and onto the road while he was going 100 kph (62 mph). He braked so hard the back wheel off the ground, and when he impacted, he and the motorcycle both catapulted over the cow (the cow lived). He had a broken femur and needed surgery. He relied on the guide who knew how to contact local emergency services, air ambulances and spoke the local language.

Here’s a fictional example of how medical evacuation insurance works without search and rescue:

- Maria was traveling in a rural part of Peru when she suddenly falls ill with severe abdominal pain. She manages to reach a small local clinic, where the doctors diagnose her with a condition requiring urgent surgery that the clinic cannot perform. Fortunately, Maria has medical evacuation insurance. She contacts her insurance provider, which quickly arranges for her transportation to a larger, well-equipped hospital in Lima. The insurance covers the costs of the air ambulance that flies Maria from the rural clinic to the city hospital, where she receives the necessary surgery and care.

Here are three fictional scenarios to give you a feel for how search and rescue insurance works:

Evaluating Insurance

You have to evaluate a lot of things including, but not limited to:

- Which evacuation/rescue insurance?

- Does it include medical evacuation, flying you from a remote hospital to one in your home country?

- Does it include search and rescue, getting you off of a mountain or out of a valley?

- Does it include medial insurance, paying the local medical staff?

- Does it include repatriation of remains, getting your body back home if you die?

- Is it reimbursement or does it prepay?

- Should you buy direct, or go through a broker?

- Which satellite device?

- Which satellite network?

- What are the best practices to prevent headaches when filing a claim?

To make this as easy as possible to understand, I’ll boil this down to a set of bullets, in order of what I think is important:

- Medical Evacuation: Covers transportation to the nearest adequate medical facility and potentially to your home country if necessary. Pretty much all of the companies I’ve found provider this service. Even my Chase Sapphire card provides this service. Some only evacuate if it’s “medically necessary” others allow you t demand evacuation.

- Search and Rescue: Covers rescue operations, especially if you’re engaging in activities like hiking, skiing, motorcycling or traveling to remote locations. A much smaller subset of the insurers actually provide this service.

- Communication Services: Look for policies that include emergency communication services which can translate into the local language, and provide the local doctors with specialized advice. I read a story about a lady on an archaeological expedition who flipped over in a Jeep and was injured in the middle of the Sahara desert. The local doctors didn’t diagnose a problem with her spleen, but the doctors on the phone in the US did. They evacuated her to a major city with a sophisticated hospital and she had surgery, probably saving her life. This service might also be useful to stay in touch with family and authorities.

- Geographic Limitations: Verify if there are any geographic restrictions on the coverage, especially if you are traveling to multiple countries. OFAC financial sanctions in Iran, Cuba, Russia, etc can prevent your insurance from paying for services rendered in a sanctioned country. You’d be on the hook to pay yourself. It can also hinder rescue because they will need to send a third party company from a nearby country. For example, I heard a story about a person rescued from Cuba, and they had to send a team from Mexico where the insurance could pay them. Also, I’ve seen restrictions on countries because of fraud. Apparently, there was so much fraud in Nepal that Ripcord stopped services there. Be careful with these restrictions when buying insurance, it’s best to call them.

- Covered Activities: Make sure that the activities you plan to participate in are covered. High-risk activities might require additional coverage or specific policies.

- Maximum Coverage Amounts: Review the maximum payout limits for evacuation and medical expenses. Ensure these are sufficient given the potential costs in the areas you are visiting. The medical evacuation provided with credit cards is in the $100,000 range, but more expensive insurance covers $500,000-750,000 which is useful because mountain rescue can be quite expensive in remote locations.

- Pre-existing Conditions: Understand how the policy handles pre-existing medical conditions. Some policies may exclude them or require additional riders.

- Duration of Coverage: Check the duration of coverage offered and whether it aligns with your travel plans. Often, it’s best to just go with an annual plan because it’s only slightly more than 14-30 days.

- Reputation of Insurer: Research the reputation of the insurance provider. Look for reviews and ratings from other travelers. But, be careful. Every insurance provider seems to have both good and bad reviews. Apparently, there are a lot of people that don’t read their policy before leaving for adventure, and then are displeased with the results. Mileage may vary.

- Repatriation of Remains: Verify that the policy includes repatriation of remains in case of death. Apparently, this is trickier than most people think, and although it’s morbid, you don’t want your loved ones stuck with this problem.

- Medical Expenses: Some cover medical expenses, including hospital stays, treatments, and any necessary follow-up care. This is not critical to me, because I have overlapping coverage with my health insurance, and credit card. Often, the insurer will help try to arrange a primary care physician or hospital, but these insurers often don’t have pre-arranged agreements, so you pay out of pocket and are reimbursed later.

- Network of Providers: Check if the insurer has a robust network of medical facilities and evacuation partners in the regions you are traveling to. This seems like a somewhat useful capability because you don’t have to pay anything out of pocket with primary care physicians and hospitals, especially in the case of quasi-emergencies like illness.

- Travel Assistance Services: Some policies offer additional services like trip interruption coverage, travel delay benefits, and concierge services. Most adventure travelers aren’t going to need this, as they have credit cards like the Chase Sapphire or American Express Gold/Platinum/Black.

Example Providers

- Medjet: Known for offering comprehensive evacuation services to a hospital of your choice, not just the nearest adequate facility. They have their own planes and they use that as a selling point. An insurance broker I spoke to mentioned that this is a strength and a weakness. While it offers them more flexibility to transfer you at your demand, it might be slower to get an air ambulance to you.

- Global Rescue: Offers extensive rescue and evacuation services, including for adventure activities. This seems to be the most popular and largest provider. They’ve been in business since 2004, and seem to have done many, many, many rescues on every continent.

- Ripcord: This is the one I was really leaning towards when I started all of this research for Nepal and Tibet. Apparently, it was started by a couple of former special forces guys who worked at or were founders at Global Rescue and wanted to fix some gaps in Global Rescue’s plans. Ripcord will prepay for rescue, but reimburses for medical at the hospital. Regrettably, Ripcord isn’t operating in Nepal because of too many cases of fraud (e.g. minor injury, but still want to go home).

- GeoBlue: I called a broker, and this is one of the providers they recommended for Nepal. It’s ran by Blue Cross Blue Shield, and their selling points are that they use use a network of air ambulances so that they can get one to you as quickly as possible. They also have prearranged agreements with primary care physicians and hospitals in a bunch of countries. For example, they have arrangements with three hospitals and nine primary care physicians in Kathmandu. That means, they can pay for you at the time services are rendered.

- Allianz Global Assistance: Provides a broad range of travel insurance products, including medical evacuation and comprehensive travel insurance. I don’t have experience with them, and didn’t find much information, but highlight them as an example of the many, many, many companies that are trying to break into this market.

Selecting a Satellite Device

After picking your insurance company, the next step is making sure you have a satellite connected device. I crashed, and was injured recently in Southeast Ohio about two hours from my house, and I can testify, that the scariest moment was the 30 seconds between looking down at my broken leg, and pulling out my cell phone to check if I had service out in the middle of nowhere. The second scariest moment was the 10 seconds before my phone connected to 911. Once I heard the operator, the next most stressful moment was trying to explain to her where I was located. Luckily, within 10 seconds, her system picked up my geolocation from my cell phone (yes, apparently that’s an automatic thing with modern smart phones). I have no idea how I had service, I think it’s because I was lucky enough to crash up on a hill. You need a satellite connected device.

When I started researching this article, I wasn’t aware that there were so many other options until I talked to the customer service person at Global Rescue. He pointed me in the direction of some of these devices, and I found some comparison blogs like this one. Some of these devices are pre-configured to reach out to specific providers (e.g. the Bivy Stick reaches out to Global Rescue directly).

- Garmin InReach: Until I did research for this article, I had really only ever heard of the Garmin InReach. Almost every motorcycle, ski, snowboard, and mountain bike video that shows a guy or gal with a satellite communicator, shows them with a Garmin InReach, that’s how I knew what they were. These cost bit more than other Satellite messaging devices but they also tie into crash detection on Garmin watches and GPSes (I have both). You really can’t go wrong with these devices.

- Zoleo: A small and rugged satellite communicator connects with your smartphone or tablet to offer seamless global 2-way messaging wherever your adventures may take you.

- Bivy Stick: a compact and efficient way to communicate from the backcountry. Not only does it offer 2-way messaging, but also it features SOS, location sharing and more.

- SPOT X: I looked at this device and liked it because it has a full keyboard, but disliked it because it was on the Globalstar network (24 Satellites) versus the Iridium network (66 Satellites, better coverage), and it’s not waterproof.

- Rent a Satellite Phone: Synchronous communication can be really nice when describing your location and injuries to a rescue team. If you break your fingers, you might not be able to text on your phone. If your phone gets broken in the crash, many of these text-based Satellite communicators will only be able to send an SOS message. You can rent Satellite phones for about $50-80 per week depending on the network and type of phone (yes, researching the satellite network is yet another rat-hole)

Notifying The Provider

Let’s walk through a scenario using a Bivy Stick ($200 Satellite device) and Global Rescue as an example:

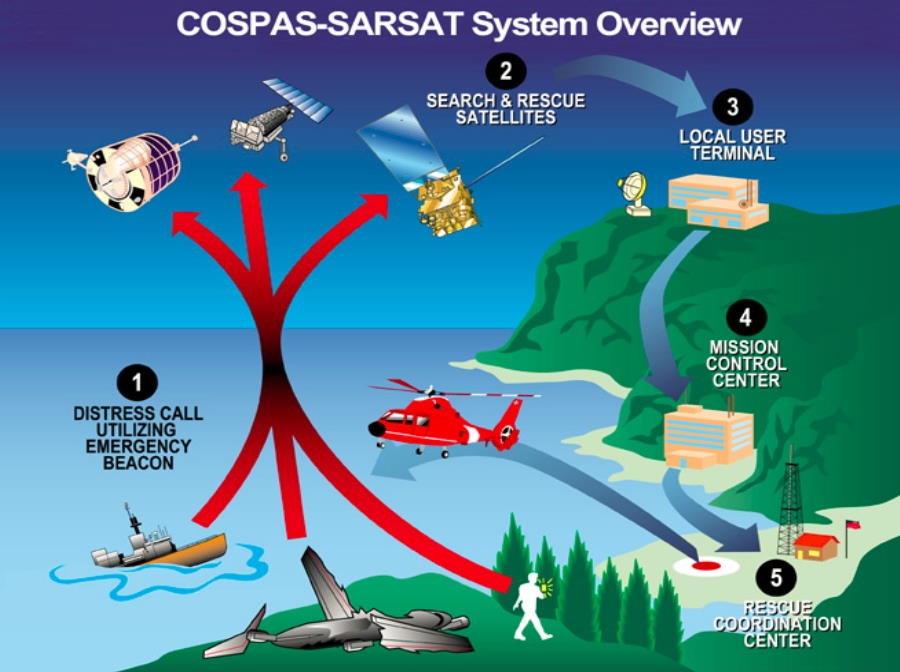

The interaction between a Bivy Stick and Global Rescue involves leveraging the satellite communication capabilities of the Bivy Stick to access Global Rescue’s emergency response services. When a user in a remote area faces an emergency, they can activate the Bivy Stick to send an SOS signal or contact Global Rescue directly, relaying their GPS location and details of the situation. This immediate and precise transmission of information allows Global Rescue to quickly assess the situation and coordinate an appropriate response, whether it involves deploying search and rescue teams, arranging medical evacuation, or providing medical guidance.

Global Rescue then mobilizes the necessary resources to assist the user, maintaining continuous communication through the Bivy Stick. This two-way communication allows Global Rescue to provide updates and receive new information from the user, ensuring an effective and adaptive response. For instance, if a hiker in Nepal uses the Bivy Stick to report an injury, Global Rescue can swiftly arrange a helicopter evacuation and guide the hiker until the rescue team arrives. The Bivy Stick and Global Rescue partnership ensures that travelers have access to timely help, regardless of their location.

Filing a Claim

Reading bad reviews and speaking to a rescue insurance broker, the number one thing I picked up is that you should document everything. Filing a claim with rescue insurance demands a methodical approach to ensure a smooth and efficient process during what can be a stressful time. First and foremost, understanding the policy thoroughly is paramount. Take the time to read through the policy documents, familiarizing yourself with the coverage limits, exclusions, and the specific claims process outlined by your insurer. Knowing precisely what is covered, including medical evacuation, search and rescue operations, and other emergency expenses, sets the foundation for a successful claim.

Once an emergency arises, prompt notification to the insurer is essential. Contact the insurer’s emergency hotline immediately to initiate the claims process. Be prepared to provide detailed information about the situation, including your policy number, location, nature of the emergency, and any other relevant details. This quick action not only ensures timely assistance but also allows the insurer to start coordinating necessary services, such as medical evacuation or local assistance, without delay.

Documenting everything related to the emergency is crucial because there is a lot of fraud in this space. Keep meticulous records of medical reports, receipts, communication with the insurer, and any other pertinent documentation. Be transparent and truthful in your communications with the insurer, providing all requested information and ensuring that all forms are completed accurately. Following these best practices will reduce your stress level, make things easier, and prevent more unhappy reviews on the Internet.

My Conclusions

Personally, I decided to go with the well-trodden path of Global Rescue with a Garmin InReach Mini 2. Here’s a few reasons summarized as bullet points:

- Most important to me, Global Rescue offers search and rescue service. On this Nepal trip, I will be with a group, but I’m not sure any of us will know how to contact an air ambulance or local services

- Global Rescue seem like the safe option, and they rescue in high altitude. Some of the passes we’re covering in Nepal and Tibet are over 17,000 feet

- I would have preferred to try Ripcord, but they didn’t service Nepal, which I need this year

- I’ve had good luck with Garmin watches, the battery life is literally 3-4 weeks, and the InReach Mini 2 seems to have this same characteristic

- The InReach integrates with the crash detection on my Zumo GPS and Fenix 5 watch (due for an upgrade)

- I like that the InReach is on the Iridium network with 66 Satellites, so it has great global coverage

- I got a deal on a refurbished InReach 2 Mini for $259 on Ebay and my butt is hurting from spending so much money recently 🙂

Good luck on your travels, and I wish you luck finding a combo that works for you. Just make sure you have a Satellite device no matter what!